Technical Analysis in Forex Trading

Table of Contents

1. Introduction to Technical Analysis

Hence, if a company’s share prices have previously risen because of unexpectedly positive earnings reports or a group of countries’ political problems strained their currency prices, today’s high trade volume with a new quarter approaching or a live news program that’s spotlighted the area of concern, however insignificant the reason, would provide information about the likely direction of future prices. As implementing technical analysis concepts is directly managed in trading, wide adoption follows a higher probability than static academic evidence, with varied trading strategies from active speculative traders to passive long-term investors.

Technical analysis involves predicting future movements in asset prices by examining past price behavior. Prices rise when demand exceeds supply. Needless to say, it doesn’t matter why supply and demand have changed. But technical analysis doesn’t bother with the reasons because all that’s needed to trade securities is to ensure that one has a good forecast of future prices. It believes that changes in supply and demand will be revealed in their behavioral patterns. One of the assumptions is that history frequently repeats itself.

1.1. Definition and Purpose

The basic presumption of every prediction is that it is possible to assume the future value on the basis of past values. The key question of official statistics of technical analysis reliability does not confirm the presumption of serviceability altogether on the basic level. It is, however, still looking for the mechanism that can explain the behavior of currency markets, especially when news does not predict exchange rates. This is especially acute for some of the accounts when it is known that there are poker factors; they can manipulate the exchange rate and make some very big moves with high frequency.

A technical analysis in forex trading is based on principles such as action is prior to the news, prices move in trends, history repeats itself, market action discounts everything, and so forth. The forex technical analysis (forex), starting from the question of whether the exchange rates may be predicted, aims to determine the future value of exchange rates for currency pairs and to enable better positioning and increase the frequency of profitable transactions.

1.2. Key Principles

Once you have learned the usefulness of long LPs, check the key levels. In this case, a very simple tool is suitable: horizontal lines. Few timeframes have reached the same level of technical analysis; use this as a confirmation of the correctness of the chosen direction. As a rule, if the signals received at overlapping levels in higher timeframes agree, they will be the most consistent and successful. If you’ve reached a conclusion and opened a position, how do you know if you did it correctly? What signals should be looked at, and when does it say that the position needs to be closed? It would be great to have a single answer to these questions that works in most situations, but in practice, the combination of stop signals seen from higher timeframes, winning target levels tested in previous LPs, and trailing stops is used.

When working with technical analysis, in particular with Forex candlestick analysis, you must always remember the following principles: As mentioned at the beginning of the article, analyzing any asset or period makes it convenient to start with the big picture, gradually narrowing the focus. When analyzing a monthly chart, use at least the last ten candles. Looking at the weekly chart, use up to three candles, and for daily use, up to two. It is better to operate on signals received in smaller timeframes only when they agree with the signals visible in higher timeframes already formed.

2. Types of Charts

Line charts are the most basic type of chart that offers the least amount of price information compared to other types such as bar and candlestick charts. Its main emphasis is on the closing price and its connection to the previous and subsequent closing prices. The line that joins daily closing prices is referred to as the ‘line.’ This chart offers a quick interpretation of price movements over time. However, the main shortcomings of the line chart are its inability to show opening and daily high and low prices. Since most traders need to trade within the high-low price range, the line chart is less helpful for a significant number of traders who are both market makers and takers. The fact that the line chart connects closing prices and ignores high-low price variation makes it difficult for market participants to set various trade settings. Moreover, the closing price is not always the optimal trade point, and during intraday trading, there are high and low positions that have to be respected. At those points, the market maker stops and takes profits, thus their relevance in market analysis.

Since the dawn of forex trading, traders and investors have been using various tools, strategies, and methodologies to analyze prices and, hence, forecast future price movements. These tools and methodologies are grouped under what is known today as technical analysis. In simple words, technical analysis is the process of examining a security’s past price movements, patterns, and various indicators to predict future price movements. These forecasts are arrived at after studying patterns on charts that prices have made in the past. Such studies are enabled by various charting techniques, of which the main three types are line charts, bar charts, and candlestick charts.

2.1. Line Charts

The best quality of the line chart is that all traders can easily recognize the construction of the currency price over a chosen period. The first point measures the price at the closure of the first time period, the second point measures the price at the closure of the next time period, and so on. The trend line that can appear can be easily defined when using the line chart. Also, the line chart presents information about trend movements a trader can predict. At the end of the period, the forex price is either increased or decreased in relation to the previous value.

Line charts are the most simple form of chart and provide useful information during analysis. They only contain one value and no further information, such as time or date. When applied to the forex market, they exclusively measure the changes in prices at the closure of the selected period. The line chart can be built with the high, low, close, and opening prices, but the most commonly used is the close price. A line chart connects the prices of a selected period several times, which creates a chart. The line chart is a part of the basic software traders use to get information about prices.

2.2.Bar Charts

The practice of reading a bar chart entails two techniques. Firstly, it presents its transition from a conventional chart in time, and secondly, it allows the trader to indicate whether the closure was higher or lower in relation to the closure on the previous day. If the closing price went up in relation to yesterday, this is a good sign. The trader courts hope for the next day’s opening, with the prospect of good forecasted turnover and the expectation of growth. If the closing price points to a decrease compared to the previous day, this is called a bear signal. Then the trader awaits the opening of a new position, hoping for a decrease and consequently a loss in the following hours. Only points lower than the open indicate the possibility of a loss, while points above the opening indicate the possibility of profit. Accordingly, a trader should always keep in mind the opening and closing prices and the number of shares, as those are the only crucial data needed to make a decision.

The open, the close, the high, and the low are four crucial points in the development of security each day. They are used to create the bar chart. Each vertical line represents one day, and the point at the top and the base of the vertical line indicate the high and the low of the day. But there are three more crucial points that will be lucrative in creating a more informative bar chart. They are the opening and closing points we described above and an additional point indicating the average between opening and closing. When the close is higher than the opening, the bar appears hollow, while the lowest point is the opening and the highest point is the close. When the close is lower than the opening, the horizontal line appears filled. The upper point then represents the opening, and the lower point represents the closing.

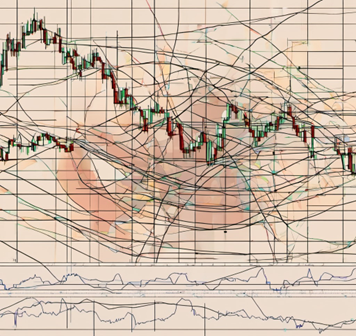

2.3.Candlestick Charts

Candlestick charts consist of open prices, close prices, maximum prices, and minimum prices. The hollow ones between the open prices and close prices, appearing in black or white if the products increase, represent bullish movement, while the dark ones representing bullish movement are called bearish candles. The thick lines on the upper and lower edges of the bodies are called the shadows. The top edge of the body shows the highest value reached during the day, while the bottom edge shows the lowest value on that day. In the daily charts, one candlestick represents the trading of one day. But again, the candles are user-defined and can be hourly, weekly, or monthly. Users can determine the time interval and see the market conditions. Candlesticks can be used on different programs, and points can be easily identified on any period by zooming in. Users can test their knowledge of candlestick patterns with the history of the graphics and develop themselves.

Candlestick charts are popular bar charts because they have created trading patterns that can be used in any bar chart. They can be used by any kind of investor, whether small or institutional, short- or long-term, and are fundamentally useful. They give more succinct ideas and enable fast evaluation. Not only do we get economic news in quick time, but they also increase the power of candlesticks.

3.Technical Indicators

Nevertheless, these notions do not intend to push traders away from using indicators that illustrate both price and period dynamics. Just remember: indicators should be viewed as a shortened form for this data. They could provide helpful summaries and therefore be easily applicable for the realization of moving average-type trading systems, but they could also lead to serious problems when used as more general forecasting tools. This suggestion serves as a reminder about what situation indicators are supposed to handle, as it is always very easy to lose track of why these functions exist. At the same time, maintenance of high-move ratings is more difficult to retain. And while these conclusions are not universally admitted, high-move ratings confirm what J. Dempster’s research concludes. The statistically significant behavior of the high-move ratings is far more common for the twelve simple reason indicators (asymmetrically weighted and unweighted) than for other indicators and their variations.

The rule of thumb is the following: indicators are designed to help traders in their primary function; they are used to recognize current market conditions. In this case, such a phenomenon as overfitting could be easily avoided. Over-fitting is often observed in popular software packages for charting, and the bulk of indicators are generated by fitting optimized parameters to historical data. Although this type of analysis and subsequent estimation of parameters could be performed in a standalone mode as payware, it is much better practice to regularly apply research tools so as to preserve their priority in real trading operations. This belief cannot be reaffirmed too often: automatic trading is based on observing and understanding current conditions, and implementations should not descend into post-estimations of what happened.

Despite the overwhelming variety of technical indicators as well as the broader range of their settings, the application of technical indicators should be simple in practical trading.

3.1.Trend Indicators

The moving average has an upward direction, and the current price moves above it. If the price was below the moving average and the bottom of the price was higher than the previous one, we can say that the price demonstrates some signs of a trend change. If the moving average has a downward direction, the current price is below it, and the price stays below the previous one, it can be assumed that the market is in an active downward trend. The purpose of the use of moving averages is to define the points of the moving average crossing by the price.

There are some rules that must be followed while constructing a trend, and technical indicators are used to make them as mechanical as possible. In common, traders use long moving averages to spot long-term trends and short moving averages for term-defining. The main indicator that is used to detect the duration of the price trend is the relative moving average. When using the relative average, it is necessary to remember that an increasing average is a bullish indicator, while a reducing one is a bearish indicator.

3.2. Momentum Indicators

Oscillator values around zero indicate a flat trend. When the momentum falls, it can reach new lows, although the market tests together on the previous significant high. This pessimistic divergence is a bearish reversal signal, announcing a potential fall in the uptrend. The opposite would represent an optimistic divergence, a signal for reversal announcements in the downtrend. A divergence is confirmed if the price starts moving in the opposite direction from the indicated potential reversal. If the bears place confidence and the reaction low maintains below the previous low, a bear market is detected. If bears lose their confidence and the price reaches new peaks, then a bullish trend could be expected.

Momentum is a leading oscillator, meaning it gives early signals before the price change actually occurs. The value of a momentum indicator is proportional to the rate of price change. A rapid increase in price over any interval will cause momentum to become positive (and vice versa), even if the price change over the same time period was a decrease.

Momentum is plotted as oscillating around 100, but it can actually assume any value. Standard practice is to look for a crossing of the 100 level for a bullish or bearish signal, with a crossing of that level from the upside being a confirmation. When the successive peaks and troughs of the indicator coincide with those of the price, then the trend is said to be strong. In such a case, we need the upward sloping of the indicator accompanied by a good increase in average volume.

3.3. Volatility Indicators

At the high volatility level, the harmful effects of random price fluctuations have to be taken into account, and transactions must be evaluated over a longer time range. By using volatility indicators, these periods can be avoided. If the security displays a low volatility level, trading can be performed in a more relaxed manner when trade fluctuations are of no concern. In the Forex market, it is extremely easy to profit from a rise in the price of securities. This market is like a constantly moving river where you can go with the flow, rarely against it. With volatility indicators, traders can make the necessary preparations for “an approach against the current flow” in a timely manner, avoiding taking bad decisions that would be harmful to the trading account.

Volatility indicators show the size and magnitude of price fluctuations. In other words, they indicate how significant the trade movements have been. High volatility is associated with significant risk, and it is therefore important to make a distinction between high and low volatility. The market is clearly at its highest risk level when the price rate increases to such an extent that the candlestick shadows noticeably differ from the body. On days when a large part of trading is near the upper or lower limit, we can conclude that the market is in an extreme situation.

4. Support and Resistance Levels

The trader is able to know from the resistance level and the moving averages when to take profits. In the same way, moving averages act as a secondary indicator, while support and resistance are the primary indicators. The support and resistance are formed because of the time zone difference. According to the chart, the forex market moves in cycles. This is an obvious aspect where a currency pair trades within a particular range over a period of time when a trading session opens and closes. In short, we know when the trend begins and ends from the support and resistance signals. The moving averages are able to pick this up, even though it is in the market tone. After the trader enters the market, it is possible for the trader to stay in the market.

Support and resistance levels, also known as the height of a range, are also critically important in the forex market. For instance, the EUR/USD is recently trading at 1.3217. A trader wants to take a long position on the currency pair. The trader believes that the price is likely to retrace back to 1.3370 support. The trader will enter a buy position at 1.3217, with the potential to hit the 1.3370 resistance level.

5. Common Chart Patterns

5.3. Triple tops and triple bottoms The “M” pattern is similar to double tops and double bottoms, but the only difference is the number of peaks and troughs. In the triple top, the price makes a third “M”-shaped pattern at the resistance. As it is similar to support, the “H” pattern resembles a pattern of double bottoms, but it is not confirmed using the same exact process. These triple patterns often represent very powerful support and resistance levels, at times when standard shapes do not provide protection for traders.

5.2. Double tops and double bottoms Double tops and double bottoms occur after the price is at relative highs or lows. These are two different patterns, but they look very similar. The “M” pattern occurs after an uptrend, followed by a movement at a relative high. The “M” pattern is formed when the price moves after the peak. Following a brief consolidation, the price moves to around the same level as the first “M” and then breaks the price and peaks around the same level. This is the evolution of a double top. Perhaps the selling pressure has weakened slightly, which might dampen the enthusiasm of the bears. At this time, the bulls have a huge emotional disadvantage, having reached the same level as the bears again, triggering even more short covering. However, once the price falls to that same level again, those same sellers have even more of an emotional problem, which gives the buyers even more of an advantage. The reverse is true for the double bottom.

5.1. Ascending and descending triangles In these patterns, there is a flat top line of resistance that meets a rising line of support in the ascending triangle and a falling line of support in the descending triangle at a single point. The resistance in an ascending triangle can be said to be moving down, and in a descending triangle, the support line would be moving up. According to the traditionalists, the prevailing long-term trend is bullish, and the price will break out through the resistance, signaling the completion of the consolidation of the upswing, with the target as the height of the triangle. However, triangles are easily subject to fake-outs. In reality, flip a coin, and you will have a 50% chance of predicting the next movement. Therefore, some look for a preferable approach that would tell you where the price would be heading after the break.