Table of Contents

Crypto beginner

Beginners, crypto curious, investors for the future, or seekers of knowledge—you are in the right place. The cryptocurrency industry is a fast-paced world that is sometimes difficult to navigate without fundamentals!

This is good. In the guide below, you will find the 5 essential points to know to learn the basics, understand, and be able to perfect your crypto education! So, are you ready? Let’s go!

What is blockchain?

The first concepts about blockchain appeared in 1981 when David Chaum, a student at the University of California at Berkeley, published a thesis defining cryptographic processes for transmitting data through anonymous communications.

At the time, it was not yet a question of virtual currency or cryptocurrencies but simply of exchanging and tracing flows of information between unidentified people without a controlling body. Cryptooblogg defines the term “blockchain” as follows:

Definition of Blockchain In short, we are talking here about a chain of blocks linked together. Hmmm, is it still a little blurry?

Let’s see from the government side if the definition sheds a little more light on us.

From a government perspective, blockchain can be defined as a secure, distributed ledger technology that allows for the transparent and tamper-proof recording of information. Here’s a breakdown of what that means for governments:

- secure: blockchain uses cryptography to ensure the confidentiality and integrity of data. Once information is added to a blockchain, it’s very difficult to alter it undetected.

- Distributed Ledger: A blockchain isn’t stored in a single location but rather replicated across a network of computers. This makes it resistant to hacking and system failures.

- Transparent: Anyone can view the information on a public blockchain, which can increase trust and accountability in government processes.

- Tamper-proof: Due to the cryptographic hashing and distributed nature, it’s nearly impossible to modify data on a blockchain without everyone on the network noticing.

Governments are interested in blockchain for a variety of reasons, including:

- Improving record-keeping: Blockchains can be used to securely track and store government documents, land titles, and other important records.

- Enhancing transparency: By using blockchains, governments can increase public trust by making it easier for citizens to see how their tax dollars are being spent or how elections are being conducted.

- Streamlining processes: Blockchain technology can automate and streamline government processes, such as issuing licenses and permits.

However, governments also recognize some challenges associated with blockchain technology, such as:

- Scalability: Public blockchains can be slow and expensive to use, which may limit their scalability for large-scale government applications.

- Regulation: The regulatory landscape for blockchain is still evolving, which can create uncertainty for businesses and governments alike.

- Security: While blockchain itself is secure, there are still risks associated with hacking and cyberattacks on blockchain-based systems.

OK, we see a little more clearly!

Blockchain is therefore a database (distributed register), like account books, for example, which can make it possible to transmit information visible to all users and which does not depend on any external organization. This of course goes through the Internet, and each transaction carried out is thus transmitted to all the computers on the network (we call it a node), so that they can keep a copy of all of the exchanges provided.

Let’s take a more concrete example for those who are not very “technological.

Imagine that you are in a shared apartment with 10 people and that you have a huge notebook. Each member of the “roommate” can freely write in a notebook each time they buy something or carry out a transaction with another roommate. Everyone therefore does the same, and all operations are visible to everyone for all members of the household.

Let us then consider that no writing in the notebook can be erased, and you have an idea of what a blockchain could be if this process were computerized and with cryptographed data (for example, by writing on a tablet instead of a notebook). But you will answer me, “And if we are talking about a shared location of millions of people”? Well, it’s the same process, but multiplied!

Certain networked computers become validators and automatically ensure that the transactions are correct, and in particular that roommate A has the necessary funds to send them to roommate B, for whom it is verified that he is able to receive them.

All operations are grouped into “blocks” of data (hence the term blockchain). The system is therefore perfectly autonomous, secure, accessible to all, and therefore does not depend on any external organization (bank, third party, etc.). It can, of course, be used for cryptocurrency transfers, but it is far from being the only sector that can benefit from these advantages!

Carriers can track goods data using blockchain, for example.

Property titles or diplomas can now be issued on blockchains, so that they are indestructible and tamper-proof.

It is also possible to trace voting and governance decisions via these famous data blocks.

But we can also split the shares of a property on the blockchain, thus allowing each owner to benefit from their own percentage of share automatically but also to receive the split rents in this way.

Still in the dark? Here’s the last little example to make sure you understand perfectly!

You buy a kebab for €5 from a merchant.

- With a traditional payment, you pay with your credit card, VISA, or Mastercard, which will therefore incur fees on your transaction (network fees), but also your bank, that of the merchant (interchange fees), as well as the state, which will apply VAT on the product, etc. 😣

Your transaction is only tracked by third parties and visible to the buyer and seller.

- With a payment via blockcha,: you only pay the network fees (which can be minimal depending on the blockchainused),) and that’s it! Your transaction is visible and verifiable by everyone. The buyer and seller are therefore clearly winners at all levels in this transaction!

As you can see, the range of possibilities is immense! The innovative technology is still in its infancy, and you now need to better understand how it works.

To find out more, you can immerse yourself in this video, available in the Bitcoin section of the site, which presents, in particular, the detailed advantages of blockchain.

This concept of blockchain is particularly exciting, but is it still necessary to develop a protocol capable of putting into action all of its functionalities and advantages for users of the service?

This is what Satoshi Nakamoto did on August 18, 2008, by reserving the domain name Bitcoin.org: Bitcoin had therefore just been born!

Nobody knows who Satoshi is, the anonymous creator of Bitcoin, which is the largest cryptocurrency today! Would Nakamoto be an institution? State ? Group of economists or engineers? The craziest theories are circulating on this subject!

On October 31, 2008, the Bitcoin Whitepaper was published in a channel dedicated to the cypherphunks of the time (a movement bringing together people aiming to protect and defend the privacy of people on different networks). Hal Finney, a talented cryptographer, joined Satoshi Nakamoto to develop and finalize the Bitcoin protocol, which resulted in the creation of the first 50 BTC in January 2009 as well as a first sending between the two protagonists.

In October 2009, a first value was given to Bitcoin; it would be 0.001 dollars for 1 BTC. This represents the cost of mining a unit with a computer.

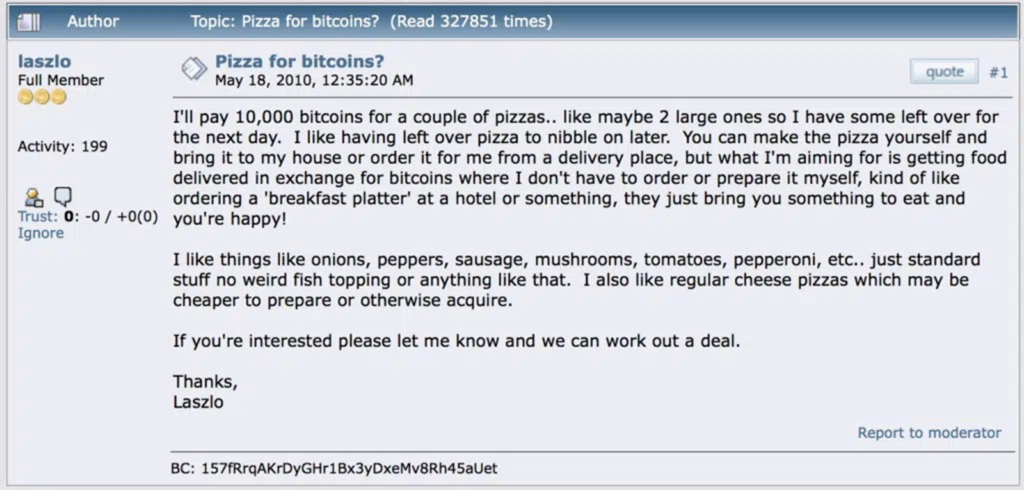

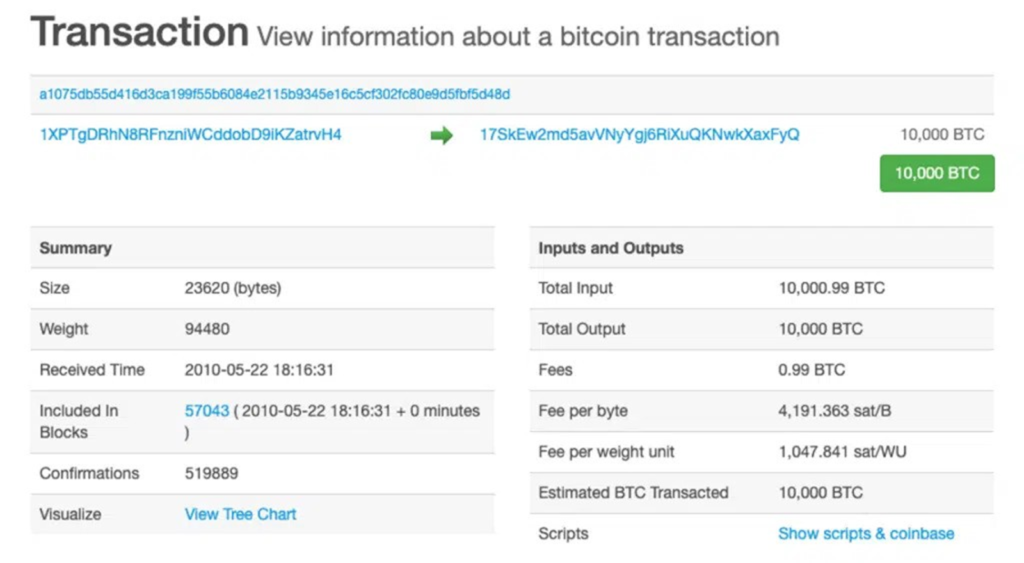

On May 22, 2010, the first purchase of bitcoin was made on the blockchain, which involved paying 2 pizzas for 10,000 bitcoins! This represents more than 370 million for two pizzas at current prices!

On December 12, 2010, the pseudonym Satoshi Nakamoto disappeared from the radar. He left a last message on the Bitcointalk forum declaring that he was withdrawing from the project and leaving the alphanumeric alert keys of the protocol to Gavin Andressen, a high-level computer scientist who would withdraw. in 2017 from the Bitcoin Foundation.

In February 2011, Bitcoin was now worth 1 dollar, then 1 euro, and the machine was launched!

The goal of the Bitcoin protocol and its currency, BTC, is therefore to promote the emergence of free, secure transactions that are not subject to collecting organizations between anonymous users; in short, all the advantages conferred by a blockchain, as we have seen above.

Since then, the value of Bitcoin has only continued to increase, and despite some hard hits, its price is now over €30,000!

Bitcoin price: Some interesting figures:

- The total Bitcoin supply represents 21 million BTC and not one more!

- Currently, more than 19 million have been mined (validation by securing the network, allowing the creation of a block). A mined Bitcoin block currently represents 6.25 BTC released, and this figure is halved every 4 years; this is called halving. Thus, the last Bitcoin mined will be around the year 2140!

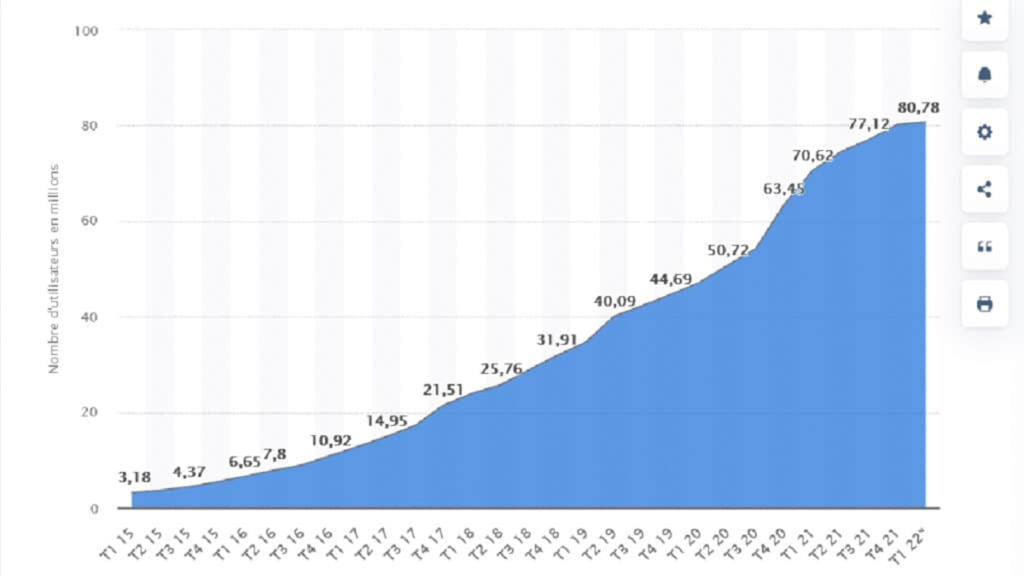

- More than 80 million people around the world currently hold Bitcoin. And you, when will it be?

- The highest value Bitcoin has ever reached is €65,096 on November 10, 2021. The market capitalization of Bitcoin will be almost 700 billion dollars in May 2022. At present, two countries have officially recognized Bitcoin as legal tender: El Salvador and the Central African Republic.

If you are still reading us here, then we can now say that you are no longer a common beginner in cryptocurrencies!

There is still one term that needs to be clarified a lot before we can continue our learning.

Blockchain and cryptocurrencies aim to be decentralized, but what exactly does this term mean?

Let’s dive back into our dictionary! Let’s turn around a bit, and this time take the larousse. Well, I must say that it’s quite clear here! The word decentralized basically defines any organization in which no single intermediary disrupts the rules of emissions and/or values. Roughly speaking, in the case of Bitcoin, a currency independent of any intermediary state or any central bank.

, this concept is more easily translated by examples close to traditional economies. I often give the following to those close to me to help them understand the decentralized world in which we will live tomorrow:

- Let’s take the evolution of banks. First of all, there are the traditional banks with our good old Alain or our Sylvie, a banking advisor behind her desk, who made us sign 250 pages to buy an apartment. Today, some online banks offer real estate loans, and everything is signed electronically, a further step towards decentralization. But in a few years, you will no longer have a bank, simply lending organizations or service platforms.

You will connect your electronic wallet with your cryptocurrencies on it, and the protocol will be able to tell you whether or not you are eligible for your request. A smart contract (an electronic contract traceable on the blockchain) will establish the framework for your operation.

The evolution of the web—we have seen it with the various confinements—and the acceleration of the development of Web 3 (the decentralized internet) have clearly favored the technological transition in everything that is a remote connection tool. Many used Skype, Zoom, Teams, or WhatsApp more intensively.

Tomorrow we will go further, and we can already find ourselves in virtual worlds (the metaverse) to participate in a concert, for example. From there, can we say that Christmas 2025 will take place at home with a virtual headset and Aunt Paulette breaking the trail with her Avatar? There is only one step.

The decentralized financial world can also be a return to more prudence and security regarding the creation of money and, in particular, inflation. Let’s think back to our apartment mentioned a little above.

Today, when you buy real estate from a bank, it lends you money that you do not have by having the central bank issue an amount that no one has, and this over a period of 25 to 30 years! Or how to issue debt and provide an incredible launch pad to generate inflation!

The subject is vast, but it allows us to understand that in a decentralized way, cryptocurrency loans are also possible, but in the vast majority of cases, they are “backed” by money already owned (example: I lend you 2 bitcoins because you already have 3 of which I am pawning). A return to basics that is more secure for the economy in the long term!

So detractors of cryptocurrencies will say that they are both centralized and decentralized, adding that decentralization is only on the “marketing” side. It’s not completely false, but it’s far from real as well.

A new era has begun with the rise of cryptocurrencies! We are only at the beginning of this, and there are still many improvements that can be made!

A decade of cryptocurrencies

We have therefore just defined 3 very important notions concerning the field of cryptocurrencies; these are essential for anyone wishing to enter the sector, whatever their ambitions.

But with Bitcoin having existed for more than 10 years now, we are leaving behind a decade of events linked to the world of cryptocurrencies and blockchain.

In traditional finance, 10 years is easily made up for, but in crypto, there is nothing like a small crossing point to understand how this new world has already been built on solid foundations for the future! So, fellow beginners, let’s put all this into perspective!

This infographic over the past 13 years allows you to dive back into the history of cryptos.

Each year is, of course, summarized and could be the subject of a much more in-depth analysis, but this chronology allows us to understand how spectacular the development of the blockchain and cryptocurrency sectors is!

And yet, we are only at the beginning of a new era.

For example, the entire capitalization of S&P 500 companies is $39 trillion! That’s almost 20 times more than the cryptocurrency sector.

It suffices to say that widespread adoption is still far away and that the possibilities for development are very numerous.

You are now armed with a little more knowledge to face the twists and turns of the sector, so you would tell me that beyond the incredible attraction for technology, most of you also have a speculative and financial interest. In view of the multiples achieved by some in the field, we can only understand you. But my role as “tutor” also requires me to alert you to the negative points that this can cause!

Know that first of all, the more your expertise on the subject is developed, the better your mastery will be and the lower your risk of losing money. So don’t limit yourself to this modest article, but explore the subjects every day, improve your knowledge, inform yourself, take care to exchange with more experienced actors, etc.

I continue directly with the usual little disclaimer: everything written in this article is not intended to advise you but rather to give examples of strategies so that you can define your own rules and your own framework.

I was on the verge of adding the very traditional “only bet what you can lose,” but I am not a fan of this expression to the extent that when I invest in a project or several, the number 1 objective is to recover my stake, number 2 is to make a capital gain. So I will stick to telling you to only invest with money that is not necessary for you to live—the budget that could be allocated to your leisure activities, outings, or vacations, for example—and, of course, not that of the month’s shopping. your toddler’s diapers, or the money you owe to your mother-in-law!

Here we are at the point on the warnings, so to define your beginner’s strategy, I suggest you think in terms of budget in order to be able to more or less categorize the types of investors.

We will not go into the technical part (how to open an account, an exchanger, create a wallet, buy crypto, etc.) in this article, so if you have questions on this point, the site is full of help of all kinds, and of course my Twitter is open for those who have any doubts!

Let’s go!

DCA is the only technical concept briefly mentioned here; it seems essential to me to know it, however, to reduce exposure to risk as much as possible. DCA (or Dollar Cost Averaging) is a type of investment that is equivalent to investing regularly in an asset over a given period (example: I buy 50 euros of Bitcoin every month for 10 years). This makes it possible to smooth out the average cost of entry into a project and therefore to limit our risk of experiencing strong increases or decreases. It is an investment technique that can be very relevant in the medium or long term in particular.

So it doesn’t matter what your budget is because even a small nest egg can help you do big things! In addition, with a lower amount, you will be able to focus on learning the mechanics of the technology and eliminate the emotional side linked to the amounts involved.

Another disclaimer before starting: all these scenarios are only examples of portfolio management and in no way constitute advice to be followed blindly. Learn to document yourself, source your information, check your assumptions, and then make your own decision once all the elements are put on the table!

Small budget: 100 to 1000 euros

Your budget will allow you to begin to understand how it works, how to use an exchanger, etc.

One idea: invest 1/3 in Bitcoin, 1/3 in Ethereum, and 1/3 in a stablecoin and alts in order to understand market variations and continue your learning.

Substantial budget: 1000 to 20,000 euros

Your budget begins to be substantial depending on your income and will allow you to integrate a small portion of additional risk. Despite everything, continue to learn tirelessly to identify future opportunities!

One idea: Invest 50% of your budget in Bitcoin and Ethereum, use the remaining 50% to buy a stablecoin and save it on a yield platform (Nexo, Celsius, SwissBorg, Yield App, etc.); you will thus be able to generate income liabilities. Another guess: You can also try the adventure on the altcoin market with a small percentage of your portfolio (10 ~ 20% of your budget), be careful not to expose yourself too much to a crush, and make rational decisions (in your head) and non-emotional decisions (in your heart). Your winnings can subsequently be used to reinvest in new projects or start a DCA on safer values.

Budget: greater than 20,000 euros (are you really reading this article?) Wow, we are already here on a little whale! Your budget clearly allows you to mix all kinds of investment strategies. It would be relevant to get closer to the projects on which you would like to bet and see with them if, beyond the financial aspect, you cannot bring them something else in their launch and/or development. Why not launch yourself into the ecosystem sustainably?

Conclusion:

That’s it : you’ve reached the end! Your view on blockchain, bitcoin, and cryptocurrencies is now sharper! However, we have only seen here a tiny part of the immensity of the sector, but we hope that this article has allowed you to clarify your initial questions as much as possible and to define the way in which you wish to evolve in this field!